Groupe Beneteau

Strong progress half-year earnings, confirming the 2021 full-year

Significant improvement in half-year earnings, benefiting from the adaptation measures decided on in 2020

Full-year outlook confirmed for 2021 despite the disruption affecting supply chains

Gradual integration of the acquisitions announced in July

Sustained level of business for the Boat and Housing business lines

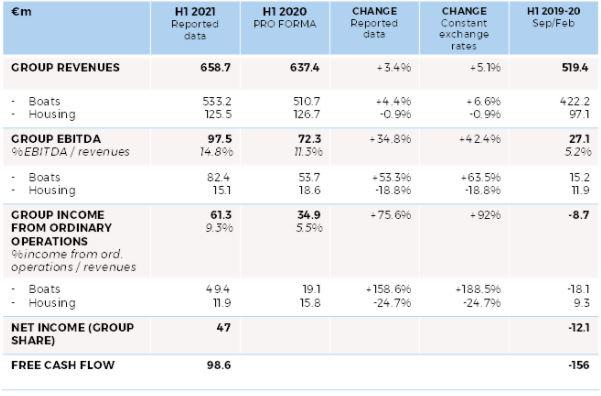

During the first half of 2021, Groupe Beneteau’s consolidated revenues climbed to €658.7m, up +3.4% compared with the pro forma first half of 2020 (+5.1% at constant exchange rates).

This growth reflects the robust development of the Boat division’s markets, with revenues up 4.4% (+6.6% at constant exchange rates), despite the contraction in fleet sales for charter professionals (-52.1%).

Excluding fleets, the Boat division’s revenues are up 14.2% (+16.9% at constant exchange rates), supported by all of the motorboat segments. This strong progress in Europe (+9%) is even more marked in North America (+16% at constant exchange rates) and in other regions around the world, where sales doubled during the first half of the year (+101.5%). In this context, the Boat division is able to confirm its full-year growth target of over 6%.

The Leisure Homes business, which was also affected by the cyberattack during the first quarter, bounced back strongly in the second quarter. In terms of exports, sales growth in Northern Europe is making it possible to offset the weak trends currently seen on the Italian market. With the deferral of certain deliveries that were scheduled for June to July, first-half sales show a slight contraction of -0.9%. After catching up on these deferrals, the Housing division is confirming its full-year growth target of over 15%, despite a fire that occurred at one of the Housing division’s seven sites on August 31, 2021. This strong growth is linked in particular to a favorable base effect during the last four months of the year, as this division had recorded a sharp slowdown in activity levels at the end of 2020.

At August 31, 2021, the global order book* represented €2,075m, up 40% based on reported data compared with end-August 2020.

* Invoiced since the start of the year and to be delivered in FY 2021 and beyond

Strong improvement in EBITDA and income from ordinary operations

First-half consolidated EBITDA came to €97.5m, representing nearly 15% of revenues (up 3.4 points) thanks to the combined impact of growth and the various adaptation measures decided on in 2020.

First-half income from ordinary operations climbed to €61.3m (9.3% of revenues), up 75.4% versus the pro forma first half of 2020 (€34.9m, representing 5.5% of revenues). It is consistent across both divisions (9.3% of revenues for the Boat division and 9.5% for the Housing division).

First-half net income close to €50m

First-half net income (Group share) came to €47m, benefiting from the reduction in financial expenses and the positive income from foreign exchange hedging (+€0.7m), while taking into account a -€16.7m tax expense for the period.

Cash position further strengthened with nearly €100m of free cash flow

During the first half of the year, free cash flow totaled €98.6m, following €61.3m of income from ordinary operations, the rationalization of investments - now lower than depreciation (€14.1m) - and a €29.6m improvement in working capital requirements over the period.

At June 30, 2021, the Group had €197.4m of net cash, a €178m improvement compared with June 30, 2020.

The €120m government-backed loan, taken out in July 2020, was paid back in full at the end of July 2021.

Full-year outlook confirmed for 2021

The Group is confirming its expectations for revenue growth of over 7% on a reported basis for FY 2021 (over 6% for the Boat division and 15% for the Housing division). These forecasts take into account the fire that affected one of the Housing division’s sites. They also include an element of caution linked to the pressures affecting supply chains around the world.

In terms of income from ordinary operations, the Group is confirming that in 2021 it aims to at least double the 2020 pro forma figure of €27.5m.

Successful rollout of a range of innovative projects and integration of acquisitions

With boat shows resuming this autumn, Groupe Beneteau unveiled a series of innovative projects in Cannes on September 6. For instance, it announced the rollout of its connected boat solution SEANAPPS, which will be fitted as standard on several ranges from the Beneteau, Jeanneau and Prestige brands, with a target to cover all boats from across the Group’s various brands from 2025.

Alongside this, the Beneteau and EXCESS brands presented their first sailing models fitted with exclusively electric engines, while the Delphia brand will be officially launched in January 2022 with a range of electric motorboats for lake and river cruising, aimed at both individual owners and river charter firms.

Around 20 new models have been announced for the 2022 season and have received a positive response from both dealers and customers.

In the sector for motorboats up to 40 feet (dayboating), the Four Winns brand unveiled the new Horizon deckboat model, while the first outboard twinhull power catamaran model will be released in 2022. The Wellcraft brand presented its new range of adventure cruisers developed for fast cruising.

In the sector for large motor yachts (Real Estate on the Water), the Prestige brand announced the launch of its third range, M-Line, offering large power catamarans aligned with expectations for larger private living spaces on the water.

Lastly, the processes to acquire the companies Dream Yacht Charter and Navigare Yachting in partnership with the PPF Group are continuing to move forward and the teams are starting to work together. The same is true for the US company Your Boat Club.

Groupe Beneteau will report its revenues for the third quarter (first nine months of the year) on November 9, 2021 after close of trading.