Beneteau

Beneteau: first-half consolidated revenue growth of 43%

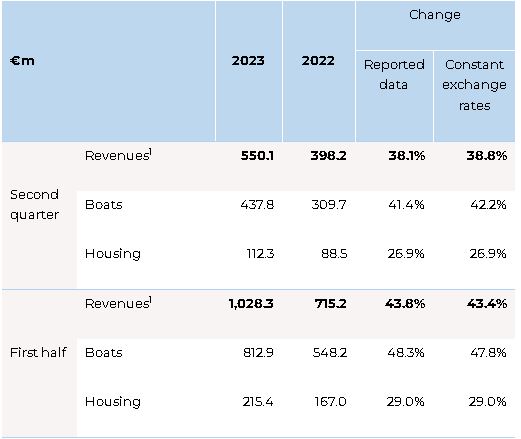

Groupe Beneteau continued moving forward with its development during the second quarter, recording a strong rate of growth, with revenues climbing 38.1% to €550m. This growth took the Group’s first-half revenues to €1,028m, up 43.8% compared with 2022.

Continued value growth for the Boat division

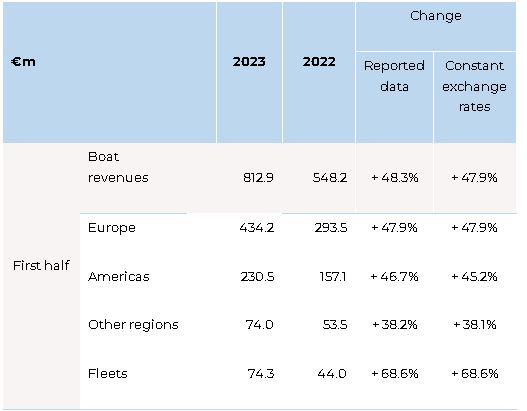

The Boat division’s first-half revenues came to €813m, up 48.3% compared with 2022. This performance reflects the Boat division’s strategy for value growth and the improvement in sourcing conditions compared with those seen during the first half of 2022, which had resulted in nearly €80m of billing being deferred.

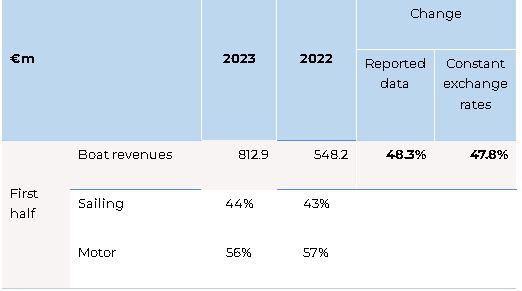

The “motorboat” business, which represented 56% of first-half boat sales, is up 45% from 2022.

For the Dayboating segment, revenue growth benefited from the continued premiumization, as well as the leading brands BENETEAU and JEANNEAU, further strengthened by the success of new models with the Antares 11 and Merry Fisher 12.95, and the extension of the product ranges offered by the American brands, illustrated by the Wellcraft Commuter 355.

For the Real Estate on the Water segment, sales were supported by the resumption of deliveries of large units by the PRESTIGE and BENETEAU brands, as well as strong demand for power catamarans.

The “sailing boat” business represented 44% of boat sales for the first half of the year. The Sailing segment recorded first-half growth of 55%, thanks to the continued strong demand, which had been anticipated with the industrial capacity increases rolled out in 2022. The upturn in purchases by charter professionals and the acceleration in growth for the EXCESS brand, which tripled its sales over the period, thanks in particular to the commercial success achieved by the new Excess 14, also contributed to this performance.

Growth was consistent across the various regions. Europe benefited in particular from the development of the network of the American brands FOURWINNS and WELLCRAFT, while in the United States, deliveries continued to be robust despite the significant increase in interest rates.

Sustained growth for the Housing division

The Housing division generated €215m of revenues for the first half of 2023, up 29% from 2022. The growth in business was in line with the sustained trends seen on the camping tourism markets. It also reflects the impacts of inflation being incorporated into sales prices. To meet the strong demand seen in France, part of the production capacity located in Italy was temporarily allocated to delivering leisure homes for French key account clients.

As announced on May 5, 2023, and following approval from the employee representative bodies, Groupe Beneteau signed an agreement with Trigano for the Housing division’s sale. This transaction remains subject to obtaining approval from the competition authorities.

New boat-related activities ramping up

Groupe Beneteau has extended its offering in services provided to end customers.

Ramping-up developments in daily boat rental sector

The Group is ramping up its operations in the daily boat rental sector, with a core ambition covering both the United States and Europe: to meet growing demand for flexible and accessible sailing through Boat Clubs.

In the United States, the Group increased its interest from 40% to 49% in Your Boat Club, a company that has been jointly owned with its two founders since July 2021. 38 bases are now in operation, including four in Florida, with a fleet of around 300 boats. Part of the renewal of this fleet is now moving forward in synergy with the Boat division through the GLASTRON brand.

At the same time, in Europe, the Group acquired a stake in the capital of WIZIBOAT with a view to taking control of this company during the summer. Its digital app, enabling short-term rental of shared boats with self-service access, is currently available at 21 bases across France. It will make it possible to extend Groupe Beneteau’s range of services for a wider audience, further strengthening its presence across the European market and supporting the activity of its extensive dealership network.

Moving forward, the Group aims to operate around 100 rental bases, spread across the two continents, with a fleet of over 1,000 boats, for around 8,000 to 10,000 members.

Premiumization supported by a personalization service

Alongside this, Groupe Beneteau has acquired a 20% minority interest in Yacht Solutions.

This company, which recorded €3.2m of revenues in 2022, offers owners of large units a wide selection of technical equipment, interiors and customizations, designed specifically for their boat model. This business combination will further strengthen the Group’s strategy for value growth, while continuing to improve the quality of its customer experience.

“With these three strategic initiatives, Groupe Beneteau is once again moving closer to its user customers, providing solutions that are aligned with the various use cases, while helping its Boat division to continue developing and opening up new business opportunities for its distribution network”, confirms Bruno Thivoyon, Group Chief Executive Officer.

Outlook for 2023 revenues confirmed, with income from ordinary operations to exceed €200m (vs. €190m previously)

While interest rates are continuing to rise and certain market segments are slowing down, Groupe Beneteau’s global order book[1] continues to be supported by its premiumization strategy and the commercial success of its latest new models.

The autumn shows will be an opportunity to showcase the new PRESTIGE F4 and M8 models, the new BENETEAU Antares 12 and Oceanis 37, and the new WELLCRAFT 435, and will make it possible to take a further step forward with the Boat division’s strategy for value growth.

The Group is able to confirm its Boat division’s revenue forecast, with over €1,450m expected for the full year, up 16% compared with 2022. This factors in a normalization of the seasonality of deliveries at the end of the year, reflecting the increase in dealership inventory financing costs (impact of higher interest rates), while inventory is now back to its pre-Covid levels in terms of volumes.

Alongside this, based on the progress with operational performance levels over the first half of the year, the Group now expects the Boat division to achieve an 11.5% operating margin for 2023 (vs. 11% previously).

Concerning the Housing division, it is forecasting full-year revenues of over €300m (over 15% growth vs. 2022), with an operating margin that is expected to be higher than 10%.

Excluding the Housing division’s planned sale, the Group therefore expects to achieve consolidated revenues of over €1,750m (+16% vs. 2022 based on reported data), while income from ordinary operations is now expected to exceed €200m (vs. €190m previously).

Groupe Beneteau will report its:

2023 half-year earnings on Wednesday September 27 (after market close),

2023 third-quarter revenues on Wednesday November 8 (after market close).