Sanlorenzo: approval of Periodic Financial Information as of 30 September 2024

La Spezia, 8 November 2024 – The Board of Directors of Sanlorenzo S.p.A. (“Sanlorenzo” or the “Company”), which met today under the chairmanship of Mr. Massimo Perotti, examined and approved the Periodic Financial Information as of 30 September 2024.

Massimo Perotti, Chairman and Chief Executive Officer of the Company, commented:

«In the first nine months of the year, the results once again confirm the solidity of our Group, which continues to grow even in challenging environments, thanks to a balanced and carefully planned strategy.

With a Net Backlog exceeding one billion euros, 90% of which is sold to final clients with whom we have established close and authentic relationships, we are immune to the stocking-destocking dynamics of distribution networks typical of players exposed to smaller-sized and/or lower-positioned product segments.

In this perspective, the significant investments made in our direct distribution network – recently expanded through the acquisition of Simpson Marine in the APAC area and organically with the creation of Sanlorenzo MED in Europe – bring us ever closer to our clients. The Group's brands will benefit from the global extension from America to the Far East, the presence of our personnel on-site, and operational synergies and technical-technological know-how.

With an increase in the order backlog of €355 million in the third quarter, of which €260 million of new orders plus an additional €96 million of pre-existing order backlog brought by Swan, the start of the yachting season with the European boat shows in September confirms the high desirability of our product portfolio – strategically complementary among Sanlorenzo, Bluegame, and Swan, without overlapping.

Our pipeline of ongoing negotiations is rich and of high quality; we expect a good conversion rate into orders in the coming months, while taking into account a general lengthening of average negotiation times.

Except for China, currently in a complex phase but with marginal weight for our Group, the number of billionaires – Ultra-High Net Worth Individuals – worldwide continues to grow structurally, creating favorable foundations for a positive dynamic between demand and supply. The latter remains limited by the scarcity of specialized labor and adequate infrastructures in the segment above 24 meters.

Strengthened by our organization and the global leadership position achieved – with a pro-forma turnover close to one billion euros for this year – we are confident in our ability to continue gaining market share in the segments most strategic, exclusive, and remunerative for us, while maintaining our quiet luxury approach.

Desirability, scarcity, and true sustainable luxury – rooted in innovation that respects tradition and aims for uncompromising quality – allow us to continue growing with stability and serenity through economic and geopolitical cycles.»

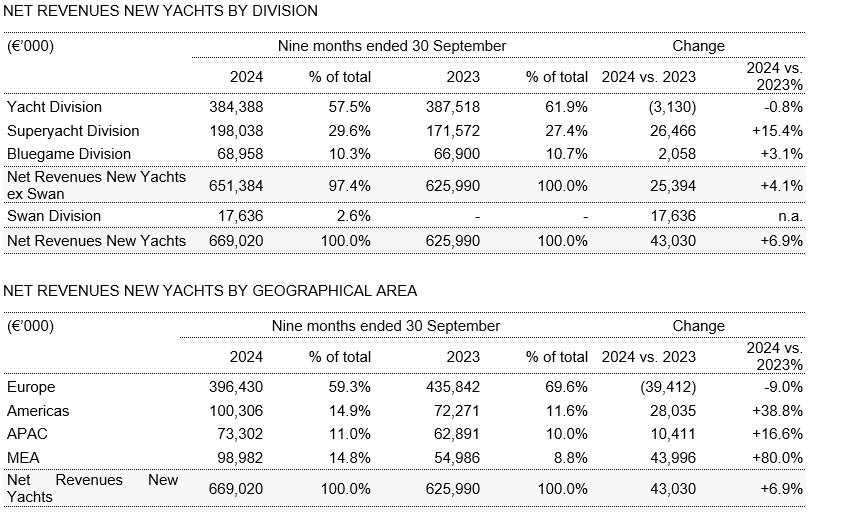

CONSOLIDATED NET REVENUES NEW YACHTS

Net Revenues New Yachts[1] in the first nine months of 2024 amounted to €669.0 million, of which €253.9 million generated in the third quarter, up by 6.9% compared to €626.0 million in the same period of the previous year.

The Yacht Division recorded Net Revenues New Yachts equal to €384.4 million, a result substantially stable compared to the first nine months of 2023. In particular, the first sales of the SP92 and SL86-Asymmetric models, presented at the recent Cannes Yachting Festival, together with the SD132 model – even before its launch (scheduled for December 2024) – have made a significant contribution.

The Superyacht Division continues its exceptional performance, with Net Revenues New Yachts equal to €198.0 million, up by 15.4% compared to the first nine months of 2023, once again driven by the Steel line.

Equally remarkable are the results of Bluegame, with Net Revenues New Yachts equal to €69.0 million, up by 3.1% compared to the first nine months of 2023. This performance, considered particularly significant given the market trend in the reference segment, has been achieved thanks to the contribution of models across all ranges.

An additional contribution comes from the Swan Division, amounting to €17.6 million, consolidated starting from 1 August 2024, whose contribution covers only 2 out of 9 months (August and September).

The geographical breakdown confirms a return to the historical trend with a more diversified mix compared to 2023: rebound in the Americas (+38.8%), strong development in the MEA area (+80.0%), and good performance in APAC (+16.6%), except for Mainland China. At the same time, Europe remains stable, showing a decrease (-9.0%) due to a comparison with a particularly strong 2023.

CONSOLIDATED OPERATING AND NET RESULTS

EBITDA[2] amounted to €123.6 million, up by 8.6% compared to €113.8 million in the first nine months of 2023. The margin on Net Revenues New Yachts is equal to 18.5%, up by 30 basis points compared to the same period of the previous year (up by 50 basis points excluding the effect of Swan's consolidation). This result once again confirms the solidity of the business model and the Group's ability to continue selling and executing successful projects.

EBIT amounted to €97.5 million, up by 6.8% compared to €91.3 million in the first nine months of 2023. The margin on Net Revenues New Yachts is equal to 14.6%, after the dilutive effect deriving from Swan's consolidation, without which the margin would amount to 14.9%, up by 30 basis points compared to the same period in 2023. Due to its smaller size, Swan has a higher incidence of depreciation and amortization on revenues compared to the Group average.

Depreciation and amortization stood at €26.1 million, up by 16.2%, due to the implementation of significant investments aimed at developing new products and increasing production capacity, as well as the additional effect from recent acquisitions.

Pre-tax profit amounted to €101.0 million, up by 7.3% compared to €94.1 million in the first nine months of 2023.

Group net profit reached €72.9 million, up by 9.0% compared to €66.9 million in the first nine months of 2023. The margin on Net Revenues New Yachts is equal to 10.9%, up by 20 basis points compared to the same period of the previous year, with a positive effect of net financial income amounting to €3.4 million.

CONSOLIDATED BALANCE SHEET AND FINANCIAL RESULTS

Net working capital was negative for €4.2 million as of 30 September 2024, compared to a negative figure of €34.9 million as of 31 December 2023 and a negative figure of €59.5 million as of 30 September 2023. The incidence of net working capital on Net Revenues New Yachts is thus substantially neutral following a reabsorption over the past year, due to the normalization of seasonality trends and order intake in the post-COVID period.

Inventories amounted to €153.6 million, up by €68.2 million compared to 31 December 2023 and up by €79.5 million compared to 30 September 2023. The increase compared to the year-end figures is mainly due to raw materials and work-in-progress products, reflecting the production ramp-up to shorten delivery times of the most requested models. Finished products inventories amounted to €43.8 million, up by €21.8 million compared to the end of 2023.

Organic net investments made in the first nine months of 2024 amounted to €27.8 million, of which 88% dedicated to expanding industrial capacity and developing new models and product ranges. The incidence on Net Revenues New Yachts reduced to 4.1% in the first nine months, mainly as a consequence of a constantly expanding revenue base, against a substantially equivalent average investment amount needed over time to develop a new model. Due to the inclusion of the Simpson Marine Group and the Nautor Swan Group in the scope of consolidation, total investments amounted to €162.1 million.

Net cash position as of 30 September 2024 was positive for €27.2 million, compared to a net cash of €140.5 million as of 31 December 2023. The evolution of the net financial position in the first nine months of 2024 shows a temporary cash absorption considering the following main effects: (i) dividend payments of €34.6 million, (ii) organic net investments of €27.8 million, and (iii) extraordinary disbursements of €82.9 million related to the purchase of treasury shares for €5.4 million in Q3 and investments in M&A. In particular, the impact on the net financial position for the acquisition of the Nautor Swan Group is equal to €53.6 million (of which €32.4 million related to the purchase of 60% and €21.2 million for the consolidation of its net financial position), while the impact for the acquisition of the Simpson Marine Group is equal to €23.9 million. Excluding these extraordinary disbursements, the net financial position as of 30 September 2024 would have amounted to €110.1 million.

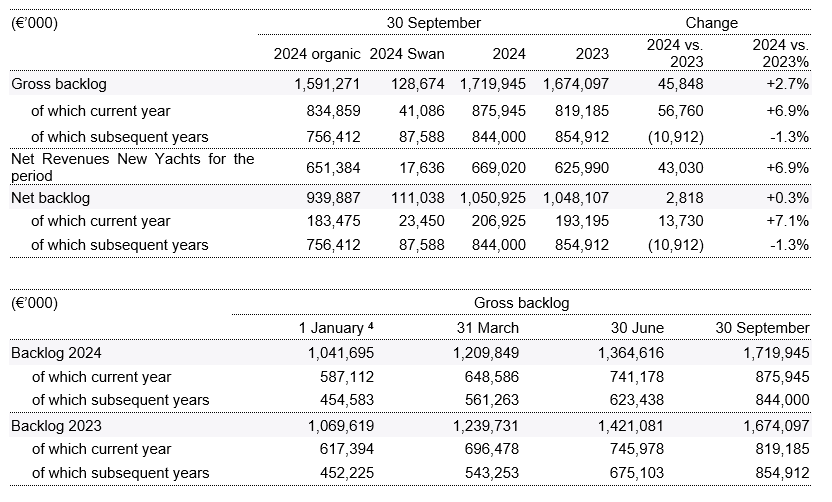

BACKLOG

As of 30 September 2024, backlog[3] amounted to €1,719.9 million, of which €128.7 million attributable to the newly acquired Swan Division, compared to €1,674.1 million as of 30 September 2023. In total, thanks to the contribution from the acquisition, this represents an increase of €45.8 million compared to the first nine months of 2023.

Net backlog as of 30 September 2024 amounted to €1,050.9 million, compared to €950.0 million as of 30 June 2024, confirming a coverage level exceeding 1.1x the annual revenues, higher than pre-COVID levels.

Furthermore, there is a confirmed high degree of visibility on future revenues both for the fiscal year 2024, with a backlog amounting to €875.9 million (94% of the mid-point of the 2024 Net Revenues New Yachts Guidance), and for subsequent years, with a total backlog of €844.0 million.

The order intake in the first nine months of 2024 amounted to €582.7 million, representing a physiological normalization compared to €604.5 million in the first nine months of 2023, partially attributable to: (i) a return to the typical seasonality of demand, compared to the extraordinary trend in the post-COVID years, and (ii) longer waiting times for superyacht deliveries, given the high backlog of orders already acquired.

Extremely positive has been the outcome of the three boat shows held in September (Cannes Yachting Festival, Genoa Boat Show, and Monaco Yacht Show), which recorded a strong turnout of clients and great commercial success for the new SL86-Asymmetric and SP92, both world-premiered at Cannes, and for the SD132 model, flagship of the Yacht Division, even before its launch, as well as for the revolutionary 50Steel of the Superyacht Division. Also this year, the three events have seen the closing of numerous commercial negotiations and many others are still in progress.

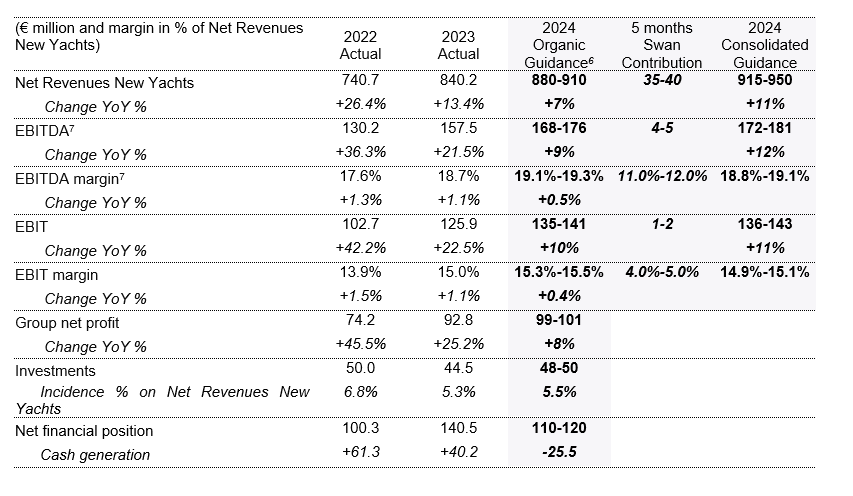

2024 GUIDANCE

In light of the solid order backlog – 90% of which is sold to final clients – while constantly monitoring the evolution of the general environment, the Company confirms the guidance for Net Revenues New Yachts, EBITDA, EBIT, Group Net Profit, and Investments for the year 2024[5], both on an organic basis and on a consolidated basis that includes the 5-month contribution from August to December of the Nautor Swan Group.

Considering the reabsorption of net working capital already achieved as of 30 September 2024 – which occurred in a shorter time frame than initially anticipated at the beginning of the year, compared to the significantly negative level as of 30 September 2023 – the Company revises the Organic Guidance for the Net Financial Position at 31 December 2024 to a range of €110-120 million (previously €160-170 million).

BUSINESS OUTLOOK

Sanlorenzo Group closes the first nine months of 2024 registering a revenue growth rate that confirms its strategy of sustainable growth over time "through the cycle," with a relatively low correlation to the economic cycle.

At the geographical level, the recovery trend in the Americas is confirmed, rebounding significantly (+38.8%) after the contraction that characterized most of 2023. The extremely positive performance of the MEA region (+80.0%) also continues, confirming it as a very interesting area for future sector growth, especially considering initiatives to build luxury marinas along the Red Sea coast like Sindalah, linked to the NEOM project. The APAC area records a +16.6% increase, benefiting from the order backlog acquired in previous quarters, despite recent weaknesses in some regions, particularly Mainland China. However, the latter still holds marginal importance for the Sanlorenzo Group (a couple of yachts per year), which sees interesting opportunities in the region, especially in the medium to long term, also due to the expansion of geographical coverage, starting from recent openings in Australia and Vietnam between June and July 2024. After several quarters of uninterrupted growth, the European area records a semester with a decline (-9.0%), partly due to a very challenging comparable base given the particularly high growth in 2023.

At the business segment level, the Superyacht Division marks the best performance, recording a +15.4% growth in the nine months, following order intake dynamics in the second half of 2023 and the first half of 2024, which saw, in a context of high interest rates and macroeconomic and geopolitical uncertainty, less sensitivity for models with a higher average price. The Yacht Division and the Bluegame Division show a trend of substantial stability, consolidating the record revenue levels of 2023, while the newly acquired Swan Division contributes for two months (August and September) with revenues of €17.6 million.

The Net Backlog, amounting to €1,051 million as of 30 September 2024, compared to €950 million as of 30 June 2024, increased during the third quarter thanks to a satisfactory order intake during the European boat show season, as well as the backlog acquired from Nautor Swan, which between pre-existing backlog and order intake in August and September contributed a total of €129 million. Therefore, visibility on future revenues remains high, with a Net Backlog coverage level (relative to 2024 revenues) exceeding 1.1x, compared to a typical pre-COVID level in the range of 0.8x-0.9x, with a decidedly high quality in terms of composition, as 90% is already sold to final clients.

In August 2024, the acquisition of the Nautor Swan Group was completed, encompassing 13 companies located in 7 countries (Finland, Italy, Spain, Monaco, United Kingdom, United States, and Australia). This acquisition represents the achievement of another fundamental milestone in the Group's strategy. Nautor Swan is a leading shipyard in the sailing pleasure craft segment, boasting an ultra-exclusive niche brand whose philosophy perfectly aligns with that of Sanlorenzo. Swan's heritage is recognized worldwide for its key elements, and the union of the Sanlorenzo and Nautor Swan brands – each with its own exclusive and limited offering, aimed at its own club of connoisseurs, without overlapping – will create a unique nautical hub in the world: the best of motor and sailing yachting. Management has developed over several months during the due diligence a solid industrial plan, in terms of product development and implementation of numerous synergies in technological, production, and commercial areas, as well as economies of scale, which are expected to yield tangible results already in the medium term.

Overall, Sanlorenzo continues to benefit from a robust trend in its traditional markets and from the competitive advantages resulting from its peculiar business model: high-end brand positioning, with exclusive yachts strictly in the upper range of the market segment between 24 and 75 meters in length, rigorously made-to-measure and distributed directly or through a limited number of brand representatives, always at the forefront of sustainable innovation.

All these are essential pillars to guarantee the long-term continuity of the virtuous dynamics experienced until today.