Turkey vs Italy: the maritime challenge between two industrial models

The comparison between Turkey and Italy in the large-yacht building sector has become even more relevant following what emerged during the Superyacht Summit Türkiye 2025. The event in Istanbul, which PressMare attended, clearly showed the pace at which the Turkish industry is consolidating its production capacity, investor appeal and strategic vision. In this context, it is useful to analyse and compare the two industrial models that currently lead the global superyacht market.

The SST (Superyacht Summit Türkiye) conference programme was opened by Ali Kamil Özmen, Head of the PPP Department at Invest in Türkiye, the investment agency of the Turkish Ministry of Economy. His speech confirmed what industry professionals have been observing for some time: Turkey is no longer an emerging promise, but a structured competitor that has been consistently and ambitiously positioning itself in the international yachting market for several years, with a clear focus on the high-end segment. However, domestic inflation now represents one of the main challenges for the long-term sustainability of this trajectory.

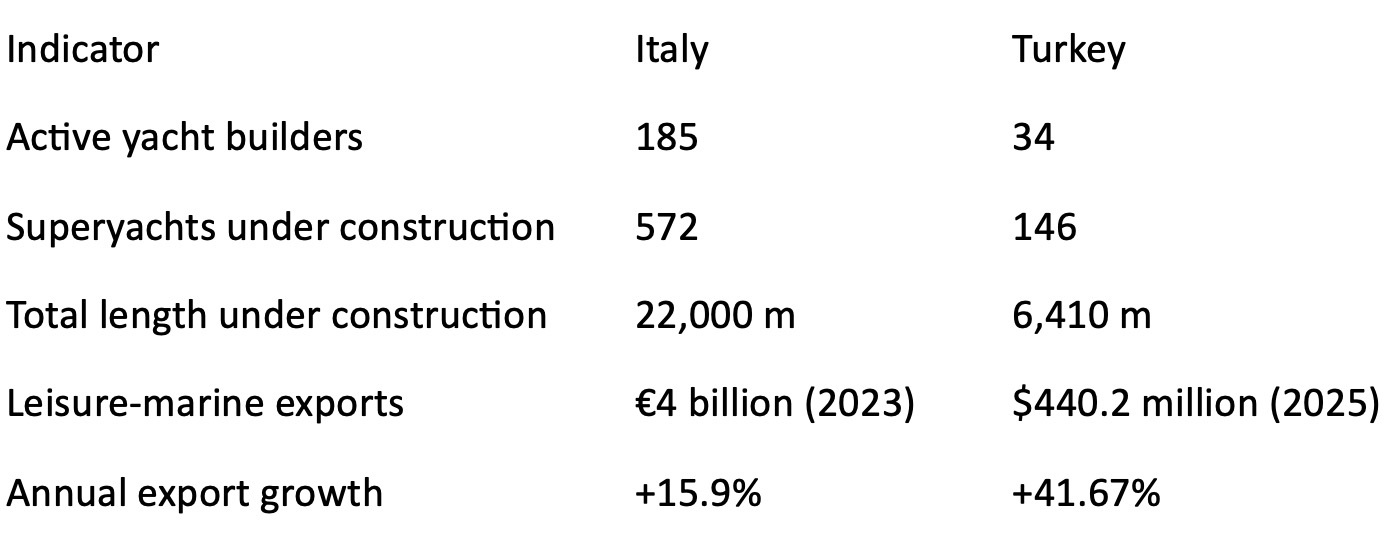

It is therefore interesting to compare a number of data points between these two key players in yacht building and leisure-marine manufacturing.

Superyachts: Italy leads, Turkey consolidates

According to the Global Order Book 2025 by Boat International, Italy maintains its global leadership with:

572 superyachts under construction;

over 22,000 metres of total length;

185 active yacht builders across the districts of Viareggio, La Spezia, Ancona and Livorno

Turkey, ranked second worldwide, confirms its position with:

146 active projects;

6,410 metres of total length;

34 active yacht builders, mainly located in Tuzla, Bodrum and Antalya

The export value of the Turkish leisure-marine sector reached USD 440.2 million in 2025, with an annual growth rate of +41.67%. Domestic sales from January to August exceeded USD 566 million, with more than 53% of yachts above 24 metres. Italy, according to Confindustria Nautica, recorded EUR 4 billion in exports in 2023, with +15.9% growth.

Two industrial model compared

Workforce and demographics: structural divergences

Turkey: over 33 million people in the active labour force (2025), with a young and growing population (average age 33). The manufacturing and shipbuilding sectors benefit from a large and flexible labour pool, with youth unemployment below 18%.

Italy: around 23 million employed (2025), with a declining and ageing population (average age 47). Youth unemployment has fallen to 22.3%, but the difficulty in sourcing skilled labour has reached 63.8% for specialised workers and 55.5% for technicians.

According to Unioncamere, 35% of Italian companies expect to hire non-EU workers in the next three years, mainly for technical and operational roles. The government has announced a three-year plan for 500,000 regular entries between 2026 and 2028.

Labour costs: Turkey’s advantage, with reservations

In Turkey, the gross monthly minimum wage is 26,005.50 TRY (about €830), with average labour costs indexed at 1,009.5 points (Turkish Statistical Institute, June 2025).

In Italy, the average hourly cost in manufacturing is about €29.5/h, compared to €6.5/h in Turkey (Eurostat, 2024).

This gap makes Turkey particularly attractive for labour-intensive production, such as hull construction, components and outfitting. Some Italian operators have already been evaluating forms of industrial cooperation or selective outsourcing to contain costs without compromising the perceived quality of the final product.

However, Turkey’s cost advantage is now under pressure from structural inflation, which is directly affecting industrial margins.

Inflation: a brake on Turkish competitiveness?

According to the Turkish Statistical Institute, annual inflation reached 32.87% in October 2025. The most affected sectors include construction, energy and building materials — all of which directly impact shipyard production costs. Rising prices for inputs, combined with currency volatility, are complicating industrial planning and the management of long-term contracts.

In this scenario, Italy’s greater macroeconomic stability — despite significantly higher labour costs — provides a competitive edge in terms of reliability, cost control and the ability to ensure consistent quality standards.

Italy also benefits from a complete supply chain, with a dense network of subcontractors, designers, craftsmen and specialised shipyards.

Turkey, however, has consolidated a more dynamic and modern industrial vision, supported by public policies, competitive labour costs and increasing openness to foreign investors.

Foreign investment and strategic outlook

Turkey has attracted USD 284.3 billion in foreign direct investment (FDI) since 2003, with 86,000 international companies active in 2024. 71.5% of FDI projects are classified as “quality investments”, with a Capex of USD 10 billion.

Italy, according to the EY Attractiveness Survey 2025, recorded 224 FDI projects (+5% compared to 2024), with a 4.2% European share. The yachting sector remains an area of excellence but requires targeted industrial policies to maintain its competitive advantage.

Turkey is no longer a new entry on the international yachting scene: it is a mature competitor with a solid trajectory and a clear strategic vision. However, domestic inflation and pressure on production costs are now critical variables. Italy, despite higher labour costs and an ageing demographic, can rely on a consolidated reputation, an integrated supply chain and greater economic stability. The challenge remains open. And while the Mediterranean once had only one capital of yachting, the future may see two — with different models, increasingly interconnected.

Cristina Bernardini

Sources

Unioncamere – Labour shortages and migration plan

Cnos-Fap – EU Skills and Jobs Programme

Turkish Statistical Institute, Labour Costs & Inflation 2025

Eurostat, Labour cost levels by NACE Rev. 2 activity, 2024

Boat International, Global Order Book 2025

EY, Attractiveness Survey Italy 2025

Confindustria Nautica, Monitor Nautica 2025

ISTAT, Noi Italia 2025

©PressMare - All rights reserved