Groupe Beneteau

Groupe Beneteau: Interim financials at August 31, 2020

The “Let’s Go Beyond!” strategic plan is moving forward in line with its schedule and is starting to deliver a range of benefits.

The Group is benefiting from its multi-specialist positioning, enabling it to offset the sharp contraction on certain markets (charter) through growth in other segments (outboard).

However, the impacts of the crisis on the last four months of 2020 remain significant, with business over this period expected to be down 25% to 30% year-on-year.

Measures to adapt production capacity and fixed costs in line with current market volumes are being rolled out and will make it possible to reduce costs by €45m to €65m on a full-year basis.

The interim results at end-August 2020 (12 months of a 16-month transition year ending December 31, 2020) are better than forecast in early July thanks to a good level of activity over the summer with the lifting of the lockdown

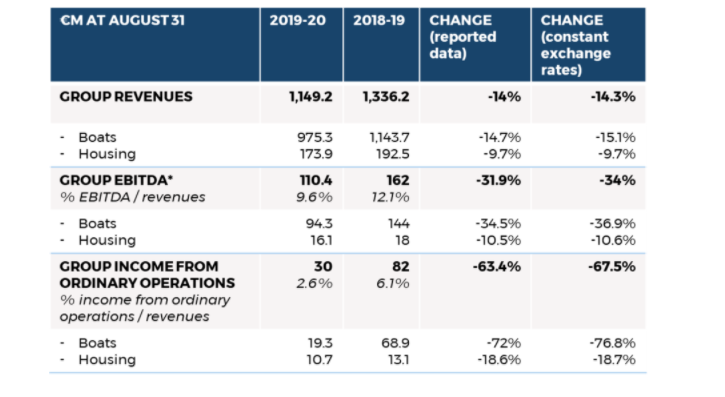

Revenues €1,149.2m -14% based on reported data

EBITDA €110.4m 9.6% of revenues

Income from ord. operations €30m 2.6% of revenues

Net cash €155.6m +€58.6m year-on-year

Groupe Beneteau is rolling out the “Let’s Go Beyond!” strategic plan presented on July 9

The House of Brands is being overhauled, with the offering realigned around eight strong brands, covering the same number of market segments as previously with 12 brands. This rationalization has enabled the Group to reduce its investments in 2020 by 30% compared with 2019 (-€26m), while maintaining a strong level of activity creating new models: 18 new models were presented to our customers this summer. Other new models are currently being prepared, aimed at very promising segments, such as small outboard powered catamarans or electric lake and river boats. These changes in the line-up are supporting a new industrial strategy for the Boat Division, focused in particular on increasingly specialized production units for each type and size of boat, while accelerating development cycles.

In an adverse environment, the Group is benefiting from its global multi-specialist positioning

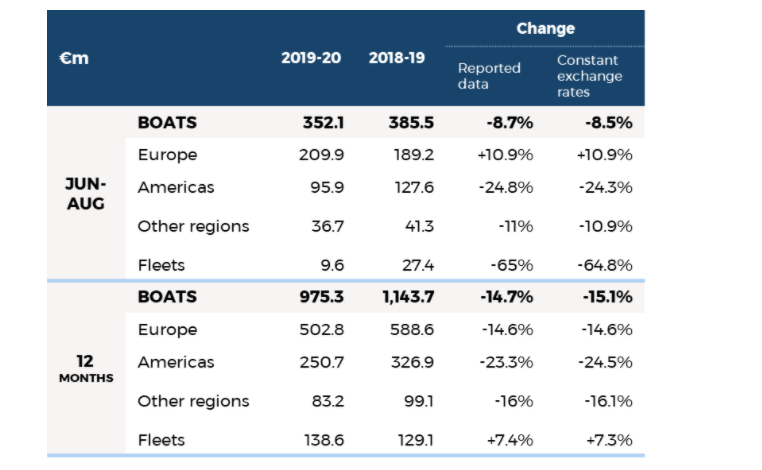

Following the end of the lockdown, the Group was able to achieve better revenues than forecast for June-August 2020, for both the Boat business and Housing, thanks in particular to a sustained level of deliveries during the summer period and lower-than-expected order deferrals.

Covering all recreational boat segments, the Group is benefiting from sales growth in the dayboating segment (motorboats up to 45 feet), partially offsetting the contraction in charter sales (mono and multihull sailing) and inboard motorboats.

However, the Group’s business during the last four months of 2020 will be down year-on-year

Revenues for the period from September to December 2020 are expected to be down 25% to 30% compared with the same period in 2019, linked primarily to the significant contraction in business for charter firms and invoicing for the Housing Division.

Taking into account the strong seasonality of its activities, the Group’s EBITDA and income from ordinary operations for the period from September to December are traditionally negative. The pro forma figures for the period from September to December 2019 show -€8.1m of EBITDA and -€35.3m of income from ordinary operations, with revenues of €247.8m.

The non-current items relating to the “Let’s Go Beyond!” plan and the industrial adaptation measures will be recognized in the accounts at end-December 2020. At this stage, they are estimated at €75m to €90m, and include the asset writedowns resulting from the “Let’s Go Beyond!” strategic plan and the costs for adapting production capacity and fixed costs in line with the expected changes in the markets post-Covid-19.

In line with its previous announcements, the Group has therefore quickly deployed the measures needed to adapt to this environment

The Boat Division has adjusted its production capacity in each country to respond to developments on its markets. In line with this, five sites have been gradually hibernated, closed or sold, with production transferred to other sites, and partial activity measures have been rolled out in France and Italy.

With most of the autumn shows cancelled, all of the brands have deployed a range of new innovative initiatives: organizing events, private trials and exclusive days in France (Cannes-Mandelieu, La Rochelle, Les Sables d’Olonne) and internationally (Monaco, Spain, Italy, UK, Germany, USA). The Group is also preparing for the opening of virtual shows (December 10-12) and creating new digital formats that are more immersive and interactive.

The Housing Division is safeguarding its production capacity with a view to capitalizing on the upturns on its domestic and international markets expected for 2022-2023.

Alongside this, the Group has continued to significantly scale back its direct and indirect fixed costs.

All of these adaptation measures should make it possible to reduce the Group’s costs by €45m to €65m on a full-year basis, including €25m to €35m of fixed costs.

Interim results at end-August better than forecast, impacted by the plants being closed for six weeks as a result of the health crisis

As Groupe Beneteau has changed its year-end date, the figures presented below are interim results for 12 months of a 16-month transition year that will end on December 31, 2020.

Revenues are down -14% compared with 2019, but higher than the -16% to -18% forecast. This improvement reflects a dynamic end to the season for the dayboating segment (motorboats up to 45 feet) and a good level of execution for leisure home deliveries.

The EBITDA margin is close to 10%, better than the 8% forecast, thanks to the cost variabilization measures put in place from the first weeks of the lockdown.

The income from ordinary operations rate of 2.6% is also higher than forecast, starting to benefit from the investment rationalization plan.

Economic impact of Covid-19 on income from ordinary operations for the period

It is estimated at €53.6m, with €67.5m linked to the six weeks during which production was shut down (€60m for Boats and €7m for Housing) and €9.6m for the remaining costs to be covered by the Group for the furlough measures, offset by an €8.7m reduction in indirect costs and a €14.8m impact on profit-sharing and company performance bonuses.

Cash position

Free cash flow at end-August totaled €90m (versus -€6.5m in 2018-19), thanks in particular to a €40m reduction in inventory and a €26.5m decrease in investments.

Cash net of financial debt at the end of the period came to €156m, which represents a €58m improvement compared with August 31, 2019, including a +€9m technical increase in financial debt, resulting from the recognition of leases under financial liabilities with the transition to IFRS 16.