Sanlorenzo approved the financial statements of 31 December 2021

Sanlorenzo approved the financial statements of 31 December 2021

The Board of Directors of Sanlorenzo S.p.A. (“Sanlorenzo” or the “Company”), which met today under the chairmanship of Mr. Massimo Perotti, examined and approved the consolidated financial statements and the draft separate financial statements as of 31 December 2021.

Massimo Perotti, Chairman and Chief Executive Officer of the Company, commented:

«Today we deliver to Shareholders and the market not only results that exceed, once again, our promises, but, in this painful and complex geopolitical context, we also confirm our forecasts. As never before, Sanlorenzo’s business model is actually proving its resilience: 91% of sales towards final clients, largely covered by significant advances, testify the soundness of the order portfolio.

The exposure towards Russian customers is marginal, representing only 7.7% of backlog, spread over three years. In fact, we have been able to seize the strong acceleration of other geographical areas, where all Group’s divisions have grown organically, starting from the United States, a key market in which we have achieved the best results. These excellent performances resulted in a remarkable cash generation that allows us to propose a dividend which is doubled compared to last year and the maximum allowed by the policy of the Company.

In this reassuring scenario, while we witness with sorrow this terrible tragedy at the heart of our Europe, we constantly monitor and assess any developments, being aware that the strength of Sanlorenzo, demonstrated even during the pandemic, enables us to face the most difficult challenges, thanks also – and above all – to the contribution of all those who work in and for Sanlorenzo, without whose dedication any effort would become unrealistic.»

Consolidated net revenues new yachts

Net Revenues New Yachts1 for the year ended 31 December 2021 amounted to €585.9 million, up by 28.0% compared to €457.7 million in 2020. In a context of strong market acceleration, this performance is a result of both a rise in volumes due to the high collection of new orders and an increase in average selling prices since late spring, made possible by the commercial positioning of the Company.

The Yacht Division generated Net Revenues New Yachts of €362.8 million, up by 23.9% compared to 2020, in all lines. The performance of the Superyacht Divisions is excellent, with Net Revenues New Yachts at €179.0 million up by 31.8% compared to 2020, driven by the Steel Line, the range with the largest yachts, and the new X-Space Line, extremely well received even before its launch.

Bluegame keeps growing with Net Revenues New Yachts at €44.1 million, up by 51.5% compared to 2020, particularly thanks to the extremely successful BGX Line. The breakdown by geographical area highlights a significant increase in the Americas, equal to 65.3% compared to 2020, particularly the United States, strategic market for the Group.

Consolidated operating and net results

Adjusted EBITDA2 amounted to €95.5 million, up by 35.3% compared to €70.6 million in 2020. The margin on Net Revenues New Yachts is equal to 16.3%, up by 90 basis points compared to 2020. EBITDA3, including non-recurring components linked to the non-monetary costs of the 2020 Stock Option Plan and the expenses incurred for COVID-19, amounted to €94.6 million, up by 36.7% compared to €69.2 million in 2020.

The constant increase in operating profits is related to the shift in product mix towards larger yachts in all divisions and the increase in average selling prices. Even in the inflation scenario started in the last months of the year, the impact of the increase in raw material prices is limited, also due to prevalence of labour in the production costs’ structure. The Group strengthened its partnerships with suppliers, to secure the procurement of key materials and components at a pre-set price through to the subscription of multiannual contracts.

The operating results also benefited from the efficiencies generated by the optimisation of the new production capacity and the resultant greater absorption of fixed costs. EBIT is equal to €72.2 million, up by 47.2% compared to €49.0 million in 2020. The margin on Net Revenues New Yachts is equal to 12.4%, up by 170 basis points compared to 2020, in spite of a 11.0% increase in depreciation and amortisation that stood at €22.4 million, following the implementation of the relevant investments aimed at increasing production capacity and developing new products.

Net financial expenses amounted to €1.2 million, down by 46.6% compared to 2020, thanks to the improvement in the conditions applied by the financial institutions and the positive refinancing of certain credit lines. Pre-tax profit amounted to €71.0 million, up by 51.4% compared to €46.9 million in 2020. Group net profit reached €51.0 million, up by 47.8% compared to €34.5 million in 2020. The margin on Net Revenues New Yachts is equal to 8.7%, up by 120 basis points compared to 2020.

Consolidated balance sheet and financial results

Net working capital was negative for €2.7 million, down by €22.0 million compared to 31 December 2020.

Inventories were equal to €68.3 million, down by €13.9 million compared to 31 December 2020. Work in

progress and semi-finished products amounted to €31.8 million, down by €13.4 million compared to 31 December

2020, reflecting the increasing order portfolio. Finished products were equal to €28.0 million and included €12.7

million referred to trade-in yachts already sold at the close of the year for delivery in the following months.

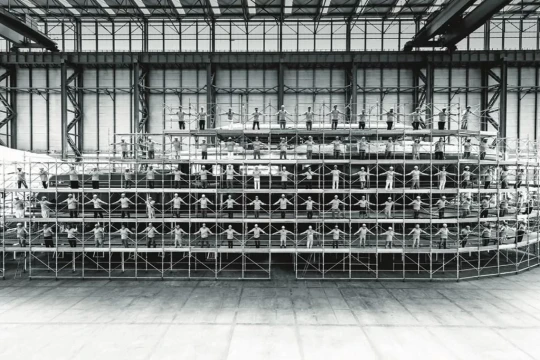

Investments amounted to €49.2 million, up by 59.7% compared to €30.8 million in 2020, of which €26.7 million

for additional production capacity, including the consideration paid for the acquisition of three industrial facilities

in the third quarter, and €17.5 million for product development and the introduction of innovations and

technologies to reduce the environmental impact of yachts.

Net financial position 4 as of 31 December 2021 was positive and equal to €39.0 million, compared to €3.8 million as of 31 December 2020. The strong cash generation, also in the presence of significant investments and dividends paid, is mainly due to the increase in volumes and the advances related to the robust collection of orders. Cash as of 31 December 2021 amounted to €141.6 million, compared to €95.0 million as of 31 December 2020. Total available liquidity was equal to €272.0 million, including unused bank credit lines equal to €130.5 million5.

Financial indebtedness was equal to €102.6 million, of which €33.5 million current and €69.1 non-current. Lease liabilities, included pursuant to IFRS 16, amounted to €4.8 million.

Backlog

As of 31 December 2021, the backlog6 , cleared from Net Revenues New Yachts recorded during the year, amounted to €915.6 million, more than doubled compared to €408.8 million as of 31 December 2020. This growth trend continued in 2022, with an order intake of €181.5 million in the first two months7 , which led the backlog as of 28 February 2022 to reach €1,097.1 million, 91% covered by final clients.

The backlog amount for 2022, equal to €622.6 million, covers 86% of Net Revenues New Yachts envisaged for the current year. Visibility on next years, totalling €474.5 million, is also significant, driven by an increased incidence of larger yachts with deliveries up to 2025.

Conflict between Russia and Ukraine

In view of the conflict between Russia and Ukraine, the Company notifies that the backlog as of 28 February 2022 includes the exposure towards customers of Russian nationality over three superyachts sales contracts, accounting for 7.7% of the total spread over three financial years. The Company specifies that these are subjects not affected by international sanctions, whose payments are regular, and as of today no order has been cancelled. Sanlorenzo still considers the related risk very limited, given the high market demand, and specifically the numerous requests received from potential European and American customers.

The Group constantly monitors the situation and the updates on international sanctions, in accordance with the strict Know Your Customer procedures and the Sanctions Compliance Program adopted by all Group companies.

Business outlook

The strong acceleration of the yachting sector continues to be supported, in the luxury segment, by the constant growth of Ultra High Net Worth Individuals (UHNWIs), in terms of both number and wealth, particularly in North America and APAC. The expansion of the potential client base is combined with a constantly increasing interest in yachting, driven by the renewed attention to well-being, and the pursuit of freedom and safety, needs that a yacht can meet.

Sanlorenzo continues to benefit from the unique characteristics of its business model: high-end positioning of the brand, exclusive yachts always at the forefront of innovation, rigorously made-to-measure, close liaison with art and design, distribution through a limited number of brand representatives, flexible cost structure. The Group’s strategy, aimed at creating value responsibly, is based on the following development guidelines.

Increase penetration in North America and APAC

Areas with a great potential thanks to the expected high growth of UHNWIs, North America and APAC are key markets for the Group’s future development. In the United States through its subsidiary Sanlorenzo of the Americas with yachts designed and built for the American market, Sanlorenzo intends to strengthen its presence with dedicated commercial and marketing initiatives and a local after-sale service. This direct distribution model may be replicated in APAC in the medium-term, with the establishment of Sanlorenzo APAC.

Evolution of the superyachts’ selling prices

In light of an unprecedented 2021 and a growing market sector, Sanlorenzo intends to progressively align selling prices of superyachts to those of the best North-European shipyards, in particular in the segment above 500GT.

Constant expansion of the product portfolio, with the introduction of sustainableinnovations and technologies

The robust product pipeline includes the launch of three new ranges, one for each division (SP Line for the Yacht Division, X.-Space Line for the Superyacht Division and BGM for Bluegame), through which Sanlorenzo will enter new high-potential market segments with proposals offering novel functions, strongly inspired by sustainability criteria. The introduction of innovations and technologies aimed at reducing the environmental impact of yachts is at the core of Research and Development, focused today on the marine application of fuel cells, activity in strong acceleration thanks to the exclusive strategic agreement with Siemens Energy.

Enhancing the high-end services offer

Consistent with the philosophy of pursuing the maximum excellence and in line with its market positioning, the Group is strengthening the offer of High-End Services, entirely focused on the proposal of a package of services intended exclusively for Sanlorenzo customers, including tailor-made leasing and financing, the first monobrand charter program (Sanlorenzo Charter Fleet), maintenance, refit and restyling services (Sanlorenzo Timeless) and crew training at the Sanlorenzo Academy. The enhancement of value proposition in services aims to increase the loyalty of existing customers and attract new ones, with a 360° made-to-measure approach, in which the excellence of manufacturing, high quality, innovation and design is combined with the exclusivity of the relationship with the customer.

2022 Guidance

In light of the consolidated results as of 31 December 2021 and taking into account the subsequent evolution of the order intake, the Company confirms the guidance for the year 20228, envisaging again a double-digit growth of the main metrics, supplemented with the Group net profit forecasts for the current year.

Financial statements of the parent company Sanlorenzo S.P.A.

The Board of Directors has also approved the draft separate financial statements of the parent company Sanlorenzo S.p.A., which recorded Net Revenues New Yachts of €533.1 million, up by 29.0% compared to 2020. Adjusted EBITDA amounted to €85.2 million, up by 29.0% compared to 2020, with a margin on Net Revenues New Yachts equal to 16.0%. EBITDA, including non-recurring components linked to the non-monetary costs of the 2020 Stock Option Plan and the expenses incurred for COVID-19, amounted to €84.3 million, up by 30.4% compared to 2020.

EBIT amounted to €63.7 million, up by 36.0% compared to 2020 and equal to 11.9% of Net Revenues New Yachts, in spite of a 15.7% increase in depreciation and amortisation that stood at €20.6 million, for the implementation of the relevant investments.

Pre-tax profit amounted to €62.9 million, up by 38.8% compared to 2020. Income taxes amounted to €18.5 million, up by €7.2 million compared to €11.3 million in 2020. Net profit amounted to €44.4 million, up by 30.5% compared to €34.0 million in 2020, with a margin on Net Revenues New Yachts equal to 8.3%. Shareholders’ equity at 31 December 2021 was €226.3 million compared to €192.4 million at the end of the previous year and the net financial position was positive for €45.0 million compared to €12.8 million at 31 December 2020.

2021 Consolidated non-financial statement

The Board of Directors examined and approved the 2021 Consolidated Non-Financial Statement, prepared as a report separate from the financial statements in accordance with the requirements of Italian Legislative Decree no. 254/2016. The 2021 Consolidated Non-Financial Statement, prepared in accordance with the Global Reporting Initiative Sustainability Reporting Standards (GRI Standard), contains information relating to the Sanlorenzo Group's activity in connection with environmental, social, personnel, human rights, and anti-corruption issues.

The Group continues to pursue a balance between financial, environmental and social objectives and encourages the involvement of all its employees in contributing to the corporate responsibility for a sustainable development. This is the meaning of the «Responsible Development» that Sanlorenzo considers an essential prerequisite for its activity.

Proposal for the allocation of profit

The Board of Directors resolved to propose to Shareholders’ Meeting the payment of a dividend of €0,60 per share for the financial year 2021, equal to a pay-out of about 40% of Group net profit, the maximum allowed by the dividend distribution policy approved on 9 November 2019. If approved by the Shareholders’ Meeting, the dividend will be paid on 4 May 2022 (ex-dividend date on 2 May 2022 and record date on 3 May 2022).

Share buy-back program

The Board of Directors resolved to submit the request for authorisation to the Shareholders, pursuant to the provisions of Articles 2357 and 2357-ter of Italian Civil Code, as well as Article 132 of Italian Legislative Decree of 24 February 1998, no. 58, to carry out purchase and disposal transactions on the Company’s treasury shares. Authorisation will be requested for the purchase, even in several tranches, of ordinary shares up to a maximum amount of 3,453,550 shares, corresponding to 10% of share capital as of 28 February 2022, for a period of 18 months starting from the date of the relevant resolution of the Ordinary Shareholders’ Meeting.

As of today’s date, the Company holds no. 58,666 treasury shares (equal to 0.170% of the share capital subscribed

and paid-in) purchased in implementation of the Shareholders’ Meeting resolution of 31 August 2020, share buyback program which was concluded on 28 February 2022.

Other resolutions

The Board of Directors approved the Report on corporate governance and ownership structures pursuant to Article 123-bis of Italian Legislative Decree no. 58 of 24 February 1998 and the Report on the policy regarding remuneration and fees paid pursuant to Article 123-ter of Italian Legislative Decree no. 58 of 24 February 1998.

Notice of call of the ordinary shareholders’ meeting

The Board of Directors has conferred powers on the Chairman and Chief Executive Officer to convene the Ordinary Shareholders’ Meeting for 28 April 2022, on first call, to approve the financial statements for the year ended 31 December 2021 and the proposal for the allocation of profit, to authorise the purchase and disposal of

treasury shares, to resolve on the Report on the policy regarding remuneration and fees paid, as well as for the renewal of the corporate offices.

The notice convening the Ordinary Shareholders' Meeting and all the relative documents will be made available to the public, in accordance with current provisions, at the Company’s offices in via Armezzone 3, Ameglia (SP), in the “Corporate Governance” sections of the Company’s website (www.sanlorenzoyacht.com) and on the eMarket STORAGE mechanism (www.emarketstorage.com).